|

US Attorney General Refuses to Prosecute Wall St. Crime

by Mark Karlin via judd - Truthout Monday, Mar 18 2013, 7:50am

international /

prose /

post

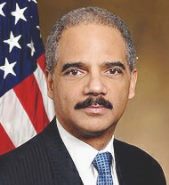

The above reality carries with it proof incontrovertible the USA is not a democracy but a Plutocracy, a nation run by a wealthy minority elite. Attorney General Eric Holder’s tragic and pathetic excuse for not pursuing Big Banks and the criminal Bankers that run them is that such an action may destabilise the economy.

Eric Holder, reprehensible black slave

A democratic leader and representative of the people would not bend to financial blackmail from any sector, group or individual especially when the solution is so easily applied -- NATIONALISE the too-big-to-fail banks and the Fed if any attempt to destabilise the economy occurs during court proceedings against Wall St. rogues and fraudsters – it really is that simple! But puppet governments must serve their true masters.

Once a democratic nation regains control of its currency/money it becomes sovereign and independent. Such a nation would apply the law equally to every citizen from beggar, president to tycoon. Indeed, a nation that ensures “justice for all” is a nation fortified by integrity, impartiality and fair play; a nation in which citizens would be proud and free but what is America today, a criminal plutocracy with a population that fears its own government.

Story from Truthout follows:

Eric Holder Enables Dishonesty, Fraud and Likely Criminal Activity on Wall Street

by Mark Karlin

Why has BuzzFlash at Truthout been writing a steady stream of commentaries documenting how the Department of Justice (DOJ) has been enabling fraudulent and likely criminal activity on Wall Street?

Well, you need look no further than the abundance of stories on how the multi-billion dollar JP Morgan Chase "whale" loss has just been exposed as the product of a systemic corporate culture at JP Morgan, all the way up to the White House "hero" of Wall Street, Jamie Dimon.

When the reckless, dishonest so-called JP Morgan Chase "whale" loss was first exposed, the business writers and politicians accepted Jamie Dimon's flippant dismissal of the financial fraud as a bump in the road, the irresponsible action of one trader. Dimon has the luminescent protective coating of being Obama's alleged model of Wall Street propriety, so the media did not doubt Dimon's reassurances for a moment.

But on March 14, the New York Times portrayed another side of the story, courtesy of a blistering United States Senate report, on the "whale" trading irregularities and cover-up. The report revealed evidence of the same kind of behavior that led to the collapse of the US economy. The NYT article is entitled, "JPMorgan Faulted on Controls and Disclosure in Trading Loss,"

JPMorgan Chase, the nation’s biggest bank, ignored internal controls and manipulated documents as it racked up trading losses last year, while its influential chief executive, Jamie Dimon, briefly withheld some information from regulators, a new Senate report says.

The findings by the Congressional investigators shed new light on the multibillion-dollar trading blunder, which has claimed the jobs of several top executives and prompted an inquiry by the Federal Bureau of Investigation. The 300-page report, released a day before a Senate subcommittee plans to question bank executives and regulators at a hearing, will escalate the debate over how to police complex risk-taking on Wall Street. It may also foreshadow a criminal case against employees at the heart of the troubled wager.

A spokeswoman for the bank said on Thursday, “While we have repeatedly acknowledged significant mistakes, our senior management acted in good faith and never had any intent to mislead anyone.”

Mr. Dimon, whose reputation as an astute manager of risk has been undercut by the trading losses, comes under the harshest criticism yet from the Senate investigators. The chief executive signed off on changes to an internal alarm system that underestimated losses, seemingly contradicting his earlier statements to lawmakers, according to the report.

He is also accused of withholding from regulators details about the investment bank’s daily losses — and then raising “his voice in anger” at a deputy who later turned over the information.

But it gets worse for the White House's favorite banker, as the Washington Post reports,

Washington dealt a double blow Thursday to JPMorgan Chase as a Senate report accused its iconic chief executive of hiding information about a massive loss from regulators while the Federal Reserve unexpectedly said it had found a “weakness” in the bank’s capital plans.

The twin announcements, both unveiled in the late afternoon, escalates the problems for JPMorgan, the nation’s largest bank and arguably its most prestigious. Once viewed as the strongest bank to emerge from the 2008 financial crisis, the firm on Thursday watched its weaker rivals, Bank of America and Citigroup, sail through the Fed’s examination.

Perhaps more pressing is a report from the Senate’s Permanent Subcommittee on Investigations, which plans to hold a hearing Friday to probe the behavior of current and former senior bank executives as they tried to contain the fallout from a series of damaging trades, initiated by a trader known as the “London Whale.” The bets ultimately cost the bank about $6.2 billion.

The Senate report is the first to suggest that JPMorgan’s chief executive Jamie Dimon was less than forthright with regulators as he learned of the mounting losses. To date, Dimon has acknowledged that the bank failed to manage its risks, which allowed the bad trades to persist.

The report takes the bank to task for hiding losses for three months last year, overstating the value of its trading positions and ignoring red flags. When regulators grew concerned, JPMorgan withheld information about the nature of the portfolio, Senate investigators say.

At one point, the bank was providing regulators daily profit and loss statements from its investment division so they could see what was going on. But Dimon put a stop to it. When one of his subordinates resumed the updates, “Dimon reportedly raised his voice in anger,” the Senate report said.

Days after losses on the portfolio jumped to more than a billion dollars, Dimon dismissed concerns about the trades as a “tempest in a teapot.”

A senior banks examiner told the subcommittee that it was “very common” for JPMorgan to push back on findings and recommendations by regulators. He recalled one instance in which bank executives even yelled at the examiners and called them “stupid.”

This is where US Attorney General Eric Holder, appointed by and apparently reflecting the Wall Street crime tolerant policies of President Barack Obama comes in. As BuzzFlash at Truthout reported in "Holder Admits That Department of Justice Believes Big Bankers Are Above the Law", Holder is enabling fraudulent and criminal activity on Wall Street by hardly investigating it, let alone potentially prosecuting the executives likely engaged in violations of the law.

If a state attorney general declares that he or she will not prosecute a Mafia don for shaking down merchants because the Mafia owns too many legitimate businesses and employs too many people – and putting the don behind empires might cause economic harm, do you think that the don is going to stop beating people over the head with baseball bats to get a cut of the profits?

That is exactly analogous to the position Holder has taken in not prosecuting too big to fail bank executives. As such, Holder is enabling Wall Street fraud and crime.

You can say it's not that simple out of deference to the chief law enforcement official in the United States, but it is.

The 2007-2008 implosion on Wall Street, which only stabilized because of a taxpayer "socialist" bail out, is doomed to reoccur because the DOJ, White House, SEC and Congress essentially condone the current outlaw activity among national financial institutions. Maybe it's all the contributions from the banking industry to both parties. Maybe it's because of the revolving door of regulators and executives in the financial industry and rich attorneys who represent them. Maybe it's just because the titans of the finance world now trump democracy.

This is corruption of the most entrenched and insidious kind, and the US attorney general's response is that some crime pays and is too big and powerful to be subject to the laws of the United States of America.

[If the law fails, the application of Justice defaults to the people in every democracy -- the joke is on you and the American people, Mr Karlin. Your conclusion misses the point and you stop short of stating that the people are responsible for the state of the nation and the conditions under which they live.]

Author retains copyright.

http://tinyurl.com/bvxyl8v

<< back to stories

|