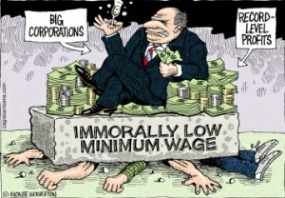

This AUSTERITY story is repeated by the corporate mass media in all western nations and if we remember the cogent words of Hitler and Goebbels, "repeat a lie often enough and people will believe it" -- AS THE MASSES BELIEVE IT TODAY! It's a croc of shit, just look at the profit figures for the major corporations over the past decade -- Transnationals and major Banks -- and the soaring wealth of the criminal 1% of society and you too will see that wealth is abundant; however, it is CLEARLY being stolen from its rightful owners, those that create it -- THE PEOPLE!

AUSTRALIAN governments are facing a budget black hole so large that politically painful cuts to growth in public health and education spending are all but unavoidable if the nation is to avoid a European-style debt quagmire.

Combined public spending across the federal and four largest state governments is forecast to outstrip their combined revenues by $60 billion a year by the early 2020s, according to new Grattan Institute analysis that incorporates the impact of new spending proposals, sputtering mining and carbon tax revenues, and a likely fall in Australia's terms of trade as the mining boom dissipates.

Assuming a small fiscal surplus in 2015, the report projects Australian governments' combined deficit will swell to an "alarming" 4 per cent of GDP by 2023 mainly as a result of increased spending, a far worse outcome than the government's most recent Intergenerational Report, which pencilled in a federal surplus of 1 per cent by that time.

John Daley, director of the Melbourne think tank, said deliberate policy choices were undermining the country's fiscal position rather than population ageing, as was widely believed, and estimated that the combined impact of initiatives, including the national disability insurance scheme, extra schools funding, and more generous paid parental leave, could be as damaging to the budget's bottom line as the expected fall in the terms of trade.

"We are facing a decade of deficits and if Australian governments don't start acting very differently, it is hard to see how we will collectively return to surplus," he said.

Dr Daley argued that Australia's economic performance was likely to be "as good as it gets" over the next couple of decades and the government should already be in surplus, even without the benefit of high export prices.

Every state except Western Australia is currently in deficit, and experts predict the federal government is facing up to a $20 billion budget shortfall this financial year as revenue growth proves far weaker than expected.

"Australian political culture has adopted as gospel that there must be 'no losers' from reform," Dr Daley told The Australian, saying both major political parties needed to be more honest about what governments needed to do to repair their budgets.

Even before this year's election campaign formally begins, both Labor and the Coalition have made promises that by 2020 they would lift federal spending by $17bn and $11bn a year respectively. "This mindset might have been affordable when government revenues were temporarily boosted by the stockmarket boom and the mining boom, but it won't work when budgets face strong headwinds," Dr Daley said.

"To close a gap of 4 per cent of GDP, the chances are that everyone will have to be a loser and share the pain."

Dr Daley's report suggests spiralling public health costs, which surged 74 per cent in real terms over the past decade, present the biggest problem for state and federal governments.

They have ballooned to one-fifth of all public expenditure, soaking up 42 per cent of all expenditure growth in excess of GDP growth over the same period. "People of any age saw doctors more often, had more tests and operations and took more prescription drugs," Dr Daley said. "Policy settings, not demography, have driven changes in government spending," he added, pointing to boosts to the level and rate of indexation applied to the age pension, which is the government's biggest single expenditure.

"Older people are working for longer, and this is likely to come close to cancelling out the effect of the ageing population on participation rates," he said.

"Real spending on government schools rose by almost 50 per cent, but did little to improve outcomes," the report also noted.

The government has proposed to lift taxes on superannuation, but yesterday Wayne Swan appeared to rule out further major spending cuts or tax hikes in the budget, despite projecting a small $1bn surplus until late last year. "It would be deeply irresponsible to cut more to make up for these revenue losses because all that would do would cause higher unemployment and lower growth and more debt," the Treasurer told the ABC's Insiders program, pouring scorn on the "savage cuts" the federal opposition supposedly want to make.

A spokesman for the Treasurer said recent Labor governments had made $150bn in savings in five budgets. "That's eight times the savings delivered by the Liberals in their last five budgets," he said, highlighting savings by means-testing the private health insurance rebate.

By contrast, the Grattan report concluded the Rudd-Gillard governments since 2008 had made decisions that culminated in extra taxes of $24bn next financial year and net new spending of $17bn.

"The net impact is only projected to positive due to revenues budgeted from the carbon tax and the minerals resource rent tax," the report said.

Dr Daley's report also suggested the federal Treasury had overestimated company and resources tax revenues by misunderstanding the impact of accelerated depreciation allowances and by making optimistic projections about commodity prices, arguing the mining tax might even collect no revenue at all. And the latest slump in the price of carbon permits in Europe threatens to wipe more than $5bn a year from revenue by 2015. Reining in growth in direct handouts to families with children, students or the unemployed were far less important than health and education.

"Australia has the most tightly targeted welfare system in the OECD by a country mile," Dr Daley said.

He pointed to Australia's low ratio of the share of GDP going to the top 80 per cent of households over the bottom 20 per cent.

"We have much less middle-class welfare than other OECD countries."

The report was ambivalent about the efficacy of the Rudd government's global financial crisis stimulus, but stressed the importance of balanced budgets over the economic cycle. "A deficit of zero -- a balanced budget -- may well be the only salient number to rally political forces for responsible government and restrain politically motivated spending," it said.

Called Budget Pressure on Australian Governments, the report is the first in a series the Grattan Institute plans that will look at how best to redress the growing gap between public revenue and expenditure.

© 2013 News Limited

[The above is the Oz version of the same bullshit (constantly) spewed from western media everywhere. The solution is simplicity itself -- TAX and regulate THE BASTARDS and distribute OUR wealth equitably throughout the community and hang/jail treasonous politicians that serve minority interests.]

http://tinyurl.com/cka29qw